- The Kelly Criterion is a betting strategy that can easily be applied to blackjack.

- This criterion is a formula that focuses on bet-sizing and expected long-term bankroll growth.

- The best way to apply this strategy is with single deck blackjack at online blackjack sites.

NEW YORK – The Kelly Criterion is a complex investment system based on probability theory, but we’ll explain how to apply this system to blackjack. A necessary piece of the puzzle is the player having an edge over the house, which can be done with online blackjack through card counting and strategy.

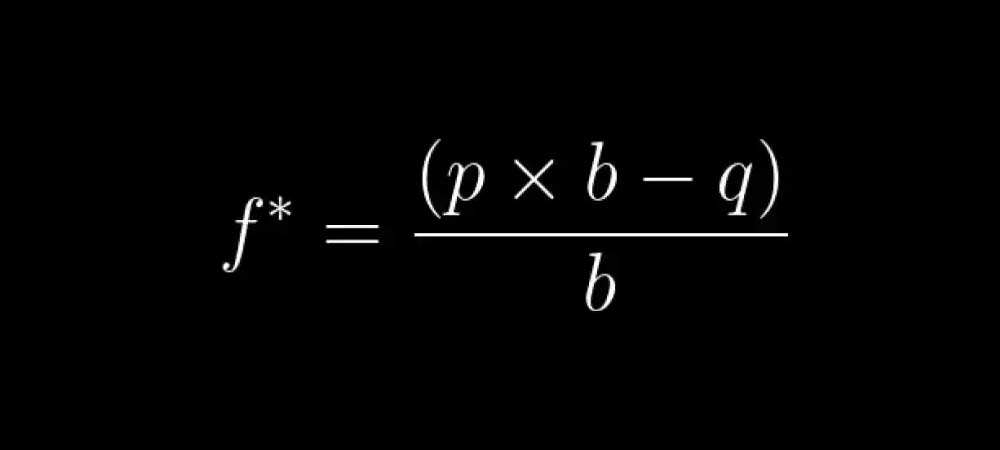

The Kelly Criterion is useless for players who don’t understand blackjack strategy or card counting. Below is one of the formulas that governs the complicated strategy, but the main focus is each individual bet as an investment rather than a progressive betting strategy.

Kelly Criterion Betting Formula In Blackjack

- f= the fraction of the current bankroll amount wagered

- b= odds on the wager (such as 3 to 2 blackjack) where b would equal 3 in this scenario

- p= probability of winning

- q= probability of losing, which equals 1-p

For blackjack, a player has a 42% chance to win while the house wins roughly 49% of the time. The other 9% results in a push, but the house edge is still 0.5% when playing a perfect strategy.

Players will have more success counting cards playing single-deck online blackjack instead of at an in-person casino. This eliminates the main disadvantage of using the Kelly Criterion, which is simply trying to pull it off in a casino environment.

If counting cards precisely, players are guaranteed a profit when playing blackjack with this investment strategy that results in a 9.07% compound interest long term. When used properly, the Kelly Criterion can be one of the best blackjack strategies for winning big.